Midtown Atlanta Market Report | July 2015 $200-300,000

Midtown Atlanta condominiums really do come in all shapes, sizes…and prices. Let’s take a look at the sales for July, 2015 for condominium sales with a price range of $200,000 to $300,000.

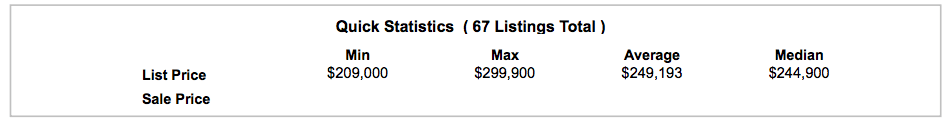

Active Listings

67 condominiums are on the market in Area 23 (Of which the majority of Midtown Atlanta is in based on the FMLS) If you are looking for a 2 bedroom, and think you can’t find one under $300,000, a look at the listings shows numerous 2 bedroom options, mind you not all of them are in the central part of Midtown. But we did see listings in buildings like Park Central, Mayfair Tower and Peachtree Walk.

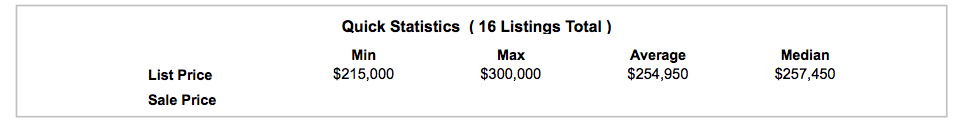

Pending (Under Contract) Listings

Just 16 homes are showing Under Contract. Keep in mind, we specifically pull those listings that went Under Contract during the month of July. There are actually 61 homes Under Contract in Area 23.

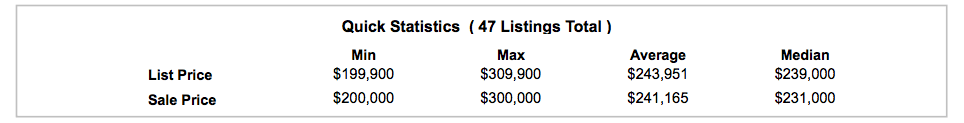

SOLD!

Here we get a bigger picture of the market….and we had a couple interesting bits with Days On Market! There was one listing with a ZERO, and the average in July, 2015 was just 21 days on the market! WOW! In comparison, in July 2014, there were 33 homes sold at an average of $247,572. While the Average Sales price is down for July of this year, I’m not concerned. It just means there were Buyers out there that picked up the low hanging fruit!

So, why did YOUR home not sell?

There can be a number of reasons, but in Midtown Atlanta condominiums, it usually has to do with your floor plan (we do have some not-so-well-thought out floor plans) or perhaps the view (both the floor and what you see out the window/balcony) and there is certainly price. If your home is on the market at Price “X” and it’s not selling, and you are not making a price adjustment, you will be ON the market. That market is telling you we are not willing to pay you what you are asking, or perhaps even make an offer at the price you have.

If you would like to see other July, 2015, Market Reports, just bookmark this post, and we will add links as we complete them.