Why Rising Mortgage Rates Push Buyers off the Fence

If you’re thinking about buying a home, you’ve probably heard mortgage rates are rising and have wondered what that means for you. Since mortgage rates have increased over two percentage points this year, it’s natural to think about how this will impact your homeownership plans. Let’s talk about Why Rising Mortgage Rates Push Buyers off the Fence!

Today, buyers are reacting in one of two ways: they’re either making the decision to buy now before rates climb higher or they’re waiting it out in hopes rates will fall. Let’s look at some context that can help you understand why so many buyers are jumping off the fence and into action rather than waiting to buy.

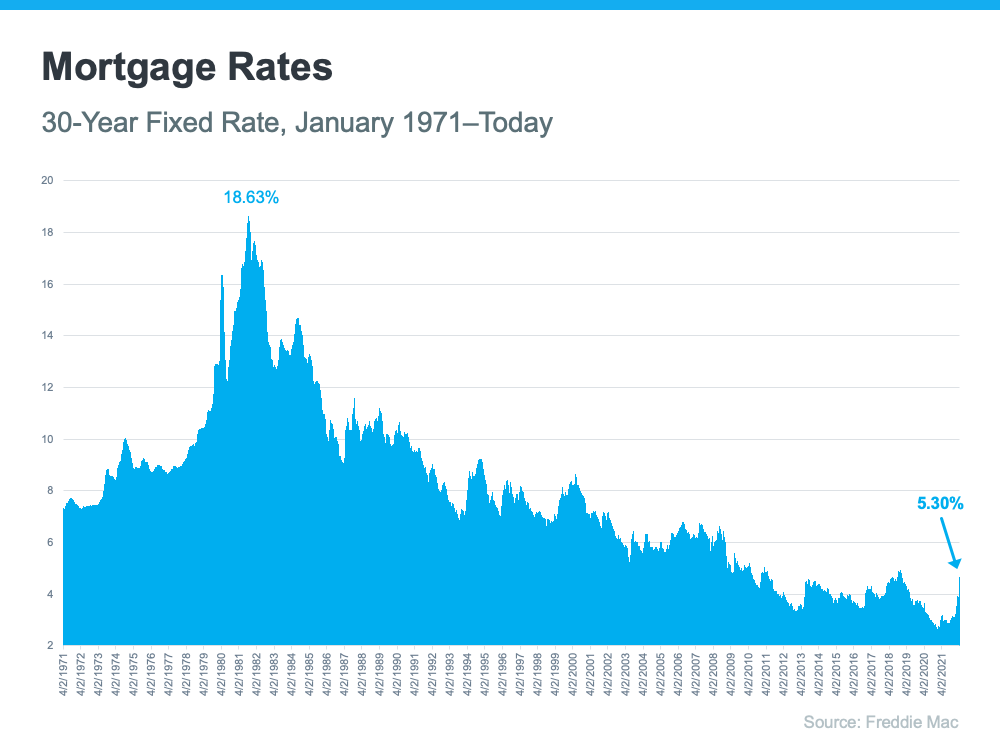

A Look Back: How the Current Mortgage Rate Compares to Historical Data

One factor that could help you make your decision to buy now is how today’s mortgage rates compare to historical data. While higher than the average 30-year fixed rate in recent years, the latest rates are still comparatively low when you look at the bigger picture of where rates have been since 1971 (see graph below):

Mark Fleming, Chief Economist at First American, explains it like this:

“. . . historical context is important. An average 30-year, fixed mortgage rate of 5.5 percent is still well below the historical average of nearly 8 percent.”

If you’re deciding whether to buy now or wait, this is important context to have. Today’s mortgage rate still gives you a window of opportunity to lock in a rate that’s comparatively lower than decades past.

A Look Ahead: What Happens if Rates Climb Further

The buyers who are springing into action now are also motivated to make their move because they know rates have risen steadily this year, and they’re eager to get ahead of any further increases.

Why? When mortgage rates climb, they impact the monthly mortgage payment you’ll have on the home you’re buying. Basically, it’ll likely cost you more to buy a home if you wait. Experts say mortgage rates will rise (although more moderately) in the months ahead. Odeta Kushi, Deputy Chief Economist at First American, explains:

“. . . ongoing inflationary pressure remains likely to push mortgage rates even higher in the months to come.”

So, if you’re ready and financially able to buy now, it may make more sense to get off the fence and make your purchase sooner rather than later. As Nadia Evangelou, Senior Economist at the National Association of Realtors (NAR), says:

“With even higher interest rates on the horizon, I don’t see any reason to hold off from purchasing a home right now. If you feel financially secure, you should start looking for a home.”

At the end of the day, there is no perfect advice on when to buy a home. What you should do depends on your goals, your finances, and your personal situation. Use this information with the help of local real estate professionals to make an informed decision on what’s best for you. The Mortgage Reports sums it up best:

“. . . if you’re on the fence about whether to buy now or wait for a better deal, buying sooner rather than later might be wise. That said, home buying is always a personal decision. Whether you should buy in 2022 depends on your financial situation and the local housing market where you live.”

Bottom Line

For many buyers, rising mortgage rates are motivating them to act now and make a purchase before rates rise higher. To decide what move is best for you, let’s connect so you have expert advice on your side. You can reach me HERE!

Fan Duel to Open $15M Tech Campus in Midtown Atlanta

Fan Duel to Open $15M Tech Campus in Midtown Atlanta Fan Duel to Open $15M Tech Campus in Midtown Atlanta

Fan Duel to Open $15M Tech Campus in Midtown Atlanta